"TheRealBicycleBuck" (therealbicyclebuck)

"TheRealBicycleBuck" (therealbicyclebuck)

07/01/2020 at 09:49 ē Filed to: None

3

3

15

15

"TheRealBicycleBuck" (therealbicyclebuck)

"TheRealBicycleBuck" (therealbicyclebuck)

07/01/2020 at 09:49 ē Filed to: None |  3 3

|  15 15 |

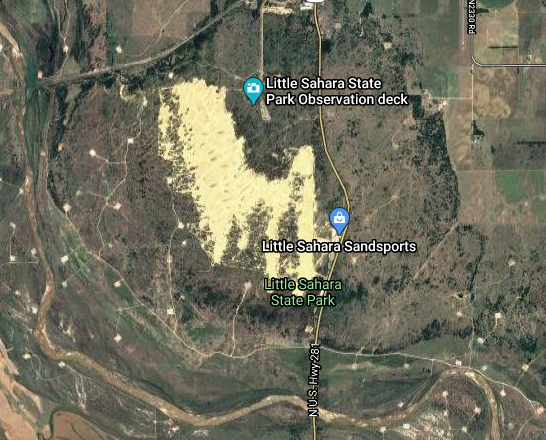

ImmoralMinorityís posts about the Oregon Dunes reminded me of my own trip there and of my trips to Little Sahara, a state park in NW Oklahoma. Little Sahara isnít much to look at when compared to places like the Oregon Dunes. Itís just 1,600 acres and the biggest dune is only about 80 ft tall, but it was close enough to home that we could get there on Friday after work, ride all day Saturday and again on Sunday morning, then be back home before dark.

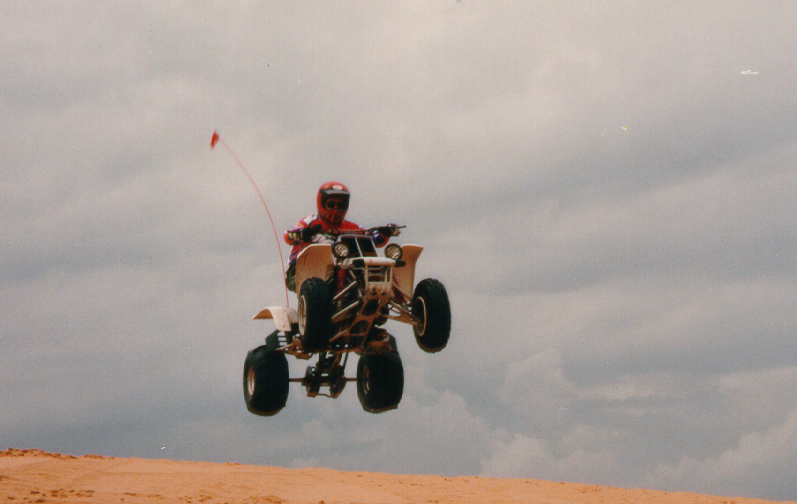

Of course, it was one of my uncles who was the enabler. He bought a pair of Yamaha Banshees, little two-stroke 350s that were perfect for shredding dunes. Today I share the one and only photo of me jumping the dunes!

ItalianJobR53 - now with added 'MERICA and unreliability

> TheRealBicycleBuck

ItalianJobR53 - now with added 'MERICA and unreliability

> TheRealBicycleBuck

07/01/2020 at 09:55 |

|

Thatís a majestic looking bird there!

davesaddiction @ opposite-lock.com

> TheRealBicycleBuck

davesaddiction @ opposite-lock.com

> TheRealBicycleBuck

07/01/2020 at 09:56 |

|

Nice!

vondon302

> TheRealBicycleBuck

vondon302

> TheRealBicycleBuck

07/01/2020 at 10:03 |

|

Ah nothing like the sound of a twin 2 stroke.

TheRealBicycleBuck

> vondon302

TheRealBicycleBuck

> vondon302

07/01/2020 at 10:08 |

|

They were screamers and they were fast.†

vondon302

> TheRealBicycleBuck

vondon302

> TheRealBicycleBuck

07/01/2020 at 10:12 |

|

I had the a 87 250r fourtrax and it was fast in the trails but in the dunes those banshees ruled.

That 250r is one of the few things I regret selling.

WasGTIthenGTOthenNOVAnowbacktoGTI

> TheRealBicycleBuck

WasGTIthenGTOthenNOVAnowbacktoGTI

> TheRealBicycleBuck

07/01/2020 at 10:15 |

|

Banshee!

I grew up in a rural town, so all the cool guys had one. I always rode whatever their dadís 2nd 4-wheeler was........

TheRealBicycleBuck

> vondon302

TheRealBicycleBuck

> vondon302

07/01/2020 at 10:24 |

|

Trails were definitely tricky on the Banshee. The two stroke was a bit doggy down low. The transition onto the pipe was like flicking a light switch and then you had ALL THE POWER!!! As you said, it was great for the dunes where you wanted the paddles floating on top and throwing sand. It could be terrifying on the trails if you werenít really familiar with how it delivered power. My uncle screwed this up once on a set of s-curves and he ended up going head-first into an embankment. They took him out on a backboard. He was lucky. He †only had a concussion and he had friends with him that weekend that were able to drive him home.

davesaddiction @ opposite-lock.com

> TheRealBicycleBuck

davesaddiction @ opposite-lock.com

> TheRealBicycleBuck

07/01/2020 at 10:30 |

|

Yikes. Glad was okay in the end.

vondon302

> TheRealBicycleBuck

vondon302

> TheRealBicycleBuck

07/01/2020 at 10:36 |

|

D ouble yikes!

Maybe it was good I sold that.

TheRealBicycleBuck

> vondon302

TheRealBicycleBuck

> vondon302

07/01/2020 at 10:43 |

|

In all the years he went out there, that was the only big wreck he had. Here he is jumping the other Banshee (he had two of them).

Under_Score

> TheRealBicycleBuck

Under_Score

> TheRealBicycleBuck

07/02/2020 at 08:44 |

|

Hello! This is really off-topic compared to your original post , but I wanted to discuss some factors about me that influence my driving record. My post this (very early) morning was kind of a ramble, so I just deleted it, especially because some seemed riled up by it. However, you had several questions, so I wanted to answer them for you.

Iím only 20 & live in Georgia, a place where people are bad drivers. I think this is why rates are higher generally. † Iíve had four accidents, and three of those have been in the past three years. However, I havenít had an at-fault since December 2017.

Iíd always been on my parentsí plan with USAA. Since USAA looks back five years, my two at-faults meant I couldnít qualify (I had an at-fault with my Ranger in 2016) for my own policy . This is why I had to get an insurance company outside of USAA. When I started my initial search in April, I was getting outrageous quotes for good coverage, most of them well over $500/month. I was getting these numbers with my 2012 Toyota RAV4 Limited, too.

Once I settled on the Alltrack, I chose Allstate because theyíre reputable and provided a great (for my record) monthly payment of around $250 . A month later, I got rear ended, and now theyíre cancelling my policy. Even though I wasnít at fault, the underwriters still wonít grant an exemption.

I can qualify for Allstate again in December, when my at-fault crash from three years ago drops.

† Theyíre gonna try to set me up with something new.

TheRealBicycleBuck

> Under_Score

TheRealBicycleBuck

> Under_Score

07/02/2020 at 09:41 |

|

Itís good that you want to continue the conversation in a constructive manner even though things may have been getting out of hand on the other thread. Iím sure that this post is buried far enough that we can have a quiet chat over here.

Just so weíre clear on perspective, keep in mind that I am old enough to be your father (my daughter is getting an early start on her first semester of college this morning) and I was an insurance agent for a while. I currently live in Louisiana which has the second highest rates in the nation. I also found myself at 20 years old with a couple of wrecks on my record and real concerns about paying for insurance.

There are a number of things you might not know which will help you understand your insurance. First, the state regulates the insurance industry and sets the base rate. Companies are allowed to set their rates above or below the base rate, but no more than a certain percentage. When I was an agent in Texas, the range was base rate plus or minus 25%. The rates are based on a number of factors including your age, gender, your driving record, the car being insured, where you live, and even your credit score. Each company weighs that information (and more) a little differently, but thereís a general consensus on the level of risk for most situations.

If you canít afford the offered rate, your only options are to shop around for something new or do your best to change those parameters. As I mentioned in the other discussion, itís really hard to change those parameters. Your basic options are:

Move - moving to a different zip code can change your rates. It also affects your rent, but know that rates in wealthier neighborhoods are typically lower than in poor neighborhoods.

Change ownership on your car - I donít know if your car is in your name, but if it is, thatís a bigger risk. One way to lower insurance is to put your parentsí names on the car and take yours off. Older owners get lower rates.

Pay off your car - Rates are higher on cars with a lien. Simple as that.

Get back on your parentís policy - I know, you were kicked off of their USAA policy. However, thereís nothing preventing them from getting another policy from a different company on just your car. Many insurance agents carry secondary policies just for situations like this. One of my uncles is a Farmerís agent, but he also represents several other companies. Farmerís doesnít write policies for high risk customers or for exotic vehicles. He has stories about people buying an exotic car o ver the weekend and discovering on Monday that they arenít covered by Farmerís . One dude drove his brand new Ferrari to Vegas right after he bought it...

Buy a different car - Itís no secret that different cars get different rates. Sure, you may LOVE your car. If you canít afford it, then you canít afford it. Look at rates for other cars. You may not like driving a minivan, but if the rates are within your budget, you may have to drive a minivan. D riving is better than walking.

Buy another car - This sounds crazy, but it can be cheaper to insure two cars than one. The trick is that your VW has to be the secondary vehicle and there canít be two drivers in the household. You might be able to get a beater car thatís your primary vehicle, making your VW your secondary vehicle. Itís a long shot, but itís worth a try.

That just about covers it. Insurance is a game. Now that you know a little more about the rules, you can figure out how to exploit them to your advantage.

Good luck.

Under_Score

> TheRealBicycleBuck

Under_Score

> TheRealBicycleBuck

07/02/2020 at 10:25 |

|

Thank you for all of this. It isnít that I canít afford $500/month for insurance, itís just that I donít want to pay $500/month. In terms of car stuff, money isnít an issue. My income isnít big, but if I can keep ďcarĒ under $1,000/month, Iím fine.

The reason I got the Alltrack is because I wanted the satisfaction of having a car thatís my own. My mom is the primary name and the license plate is her birthday right now, † but itís basically my car. If I wasnít sick today, weíd go to the tag office & try to transfer the title to having my name first . I still live with my parents and theyíre willing to pay for a lot for me, but I wanted to take a step in growing up. Paying for & insuring my car was something that mattered to me, like moving out is for others. My sister didnít have to move out a month after graduating, but she did because it was important to her & she could afford it.

My mom has brought up putting me back on their USAA plan. I like to joke when they eat out or buy something nice that itís † because they got reimbursed for my car insurance removal. Iím trying to see how well I can handle this. Iím an incredibly cheap person to the point that car stuff, gas, and fast food is all I pay for. I joked at the doctor today (I told her I was stressed for a non-sick reason, the insurance stuff) that I need to buy a Thule bike rack to stop the Alltrack from getting damaged.

What makes this terrible is that Iíve been working hard to fix my driving, especially in the past few months. In the RAV4, Iíd drive aggressively and go 90+ regularly on the Interstate. Now, I drive more responsibly. This was my first accident in 1.5 years, but Iíd only had my new insurance for a month.

The ďhigh riskĒ companies are the only ones that want to touch me right now, but Iím hoping their safe driving apps can save me.

TheRealBicycleBuck

> Under_Score

TheRealBicycleBuck

> Under_Score

07/02/2020 at 10:56 |

|

I get it. In order to become independent, free my mom from the burden of parent loans to get me through college, and get in-state tuition for the school I wanted to attend, I took a year off, moved to another state, established residency, and got a full-time job. I managed to save enough money to pay for a full year of school. That year off established me as an independent student. They changed the student loan regulations my senior year and students canít claim independence the same way I did.

Iím sure the safe driving apps youíre talking about use the bluetooth dongle to monitor your driving . Allstate started that program here in Louisiana. Iím pretty sure if they monitored my driving habits, my rates would go up.

As they say, ďsuck it up, buttercup.Ē Youíll just have to either make a change in your situation or pay what you have to pay until your situation changes. At least you are aware of the options!

As my kids transition to ďadulthood,Ē the gaps in their understanding of how the world works are becoming clear. Weíre scrambling to fill those gaps. From this discussion, Iím realizing that I have to have a long talk with both of my kids about insurance and how it works.

As they like to say, ďadulting is hard.Ē

Again, good luck.

Under_Score

> TheRealBicycleBuck

Under_Score

> TheRealBicycleBuck

07/02/2020 at 11:40 |

|

Thank you! I knew I was gonna be expensive (not $800/month expensive), so Iíve been living life accordingly. It would be fun to visit friends or go to a place like the beach †(donít tell the GMG Union avis I said that haha), but Iím laying real low to save some money.